More than just ornamentation, jewelry can be a significant means of establishing a legacy, expressing personal style, and conserving wealth. Luxury jewelry has come into its own as a wearable asset as demand for alternative investments worldwide has increased. However, when it comes to investment, not all pieces are made equal.

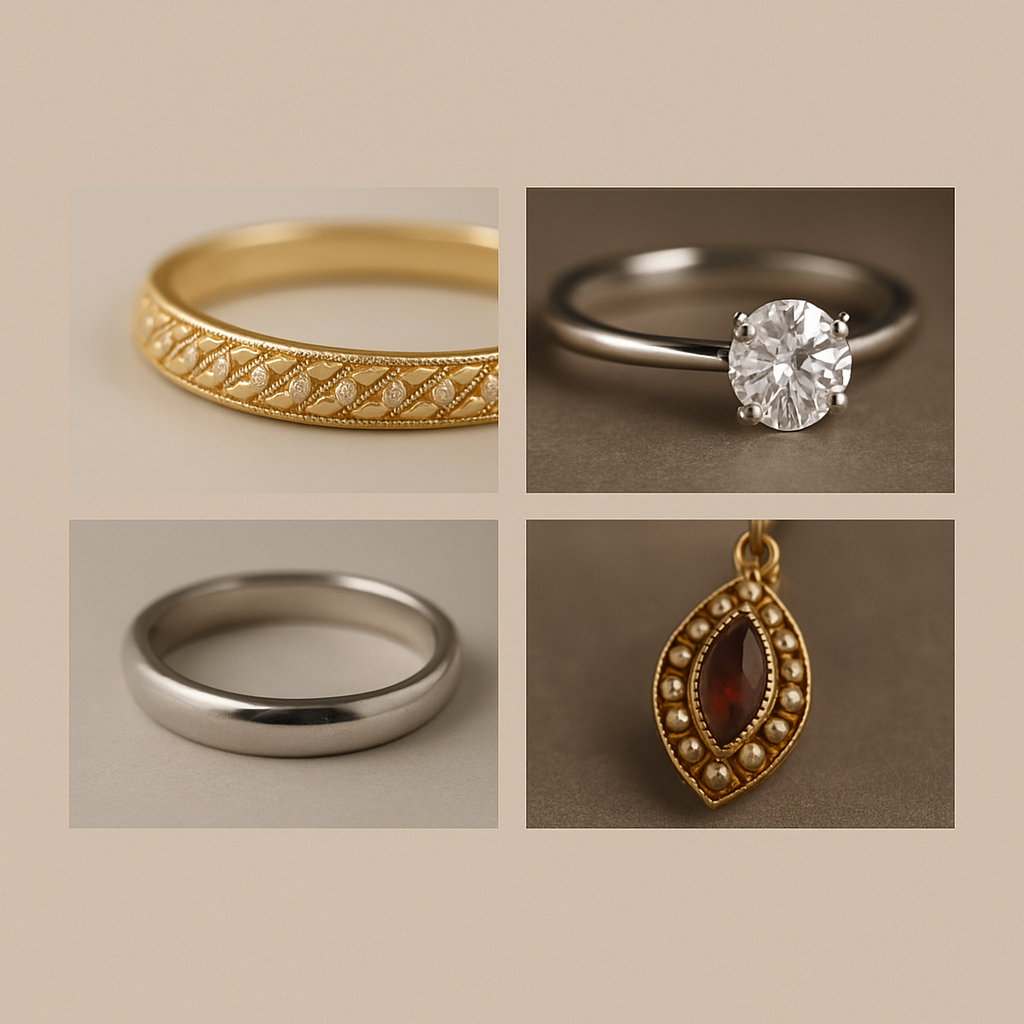

1. Gold Jewelry – Timeless Wealth That Never Fades

Why it’s a smart investment:

Gold is recognized everywhere as a store of value. It is extremely liquid, i.e., it can be readily sold or traded for cash anywhere in the world. Gold is a physical commodity that does not need any digital interface or broker, unlike stocks or crypto.

What to buy:

- The most pure gold possible is available in 22K and 24K plain gold coins, necklaces, and bangles.

- Authenticity and value preservation are ensured by BIS-certified pieces that are marked.

- Avoid overly ornate designs or heavy gemstone embellishments if your goal is resale.

Resale Tip:

The jewelry that has minimal labor costs and simple designs is simpler to market and attracts nearly the real market price.

Bonus Insight:

Gold prices increase in periods of uncertainty in the economy, and as such, is an excellent inflation hedge.

2. Diamond Jewelry – Brilliance with Long-Term Value

Why it’s a smart investment:

High-grade diamonds, particularly those graded by GIA or IGI, can retain their value and even gain value over the long term, depending on demand and scarcity. They are also less conspicuous to keep than gold and can be bequeathed as family treasures.

What to buy:

-

Solitaire rings (1.00 CT and larger) are one of the most liquid diamond investments.

-

Tennis bracelets and diamond studs remain in demand, guaranteeing demand.

- Select fine cut, F-H color, and VS1–SI1 clarity for maximum returns.

Resale Tip:

Although certified lab-grown diamonds are becoming more valuable due to ethical and sustainable demand, natural diamonds usually have greater resale potential than lab-grown diamonds.

Bonus Tip:

Diamonds with low fluorescence or no certification should be avoided as they are more difficult to assess and resell.

3. Platinum Jewelry – Rare, Resilient, and Growing in Demand

Why it's a good investment:

Platinum is less common than gold and extremely resilient. It does not tarnish or shrink over time, which makes it perfect for wear over the long term. It also has prestige and increasing popularity in high-end markets.

What to purchase:

- Simple platinum bands or male wedding bands are popular due to their strength and contemporary beauty.

- Simple pieces with limited gemstone settings are simpler to resell.

Resale Tip:

Platinum is a great long-term investment due to its durability and rarity, even though its resale market isn't as developed as gold's. Verify that it has the markings Pt950 or Pt900 (platinum content).

Bonus Information:

Since of its industrial and luxury demand, especially in the global tech and automotive sectors, platinum jewelry prices may be more stable.

4. Antique and Vintage Jewelry – Rarity That Tells a Story

Why it's a good investment:

Vintage and antique items are not only worth something in material terms but hold historical and artistic value. Rarity, brand history, and artisanal craftsmanship often translate to a higher value in the future—particularly in estate sales or auctions.

What to purchase:

- Pieces from the Victorian, Edwardian, or Art Deco eras.

- Designer vintage jewelry bearing a signature (Tiffany & Co., Cartier, Bvlgari).

- Pieces that have distinctive settings, old European cuts, or filigree.

Resale Tip:

Always have a professional appraisal and store paperwork. Provenance raises value exponentially. Buyers tend to be collectors or auction houses.

Bonus Insight:

These items tend to be one-of-a-kind, so demand may outstrip supply—particularly if well-preserved.

5. Custom Jewelry with Certified Stones – The Best of Personalization & Value

Why it's a good investment:

If made with high-quality materials and certified stones, custom jewelry can have a surprisingly high value. When well-made, these items have genuine resale potential in addition to the emotional value of personalization.

What to purchase:

- rings set with certified natural or lab-grown diamonds.

- Ethical gold (certified Fairmined or recycled, for example).

- Personalized items with timeless designs that will never go out of style.

Resale Tip:

Preserve the appraisals, invoices, and certification. If resale is a goal, steer clear of designs that are too trendy or niche.

Bonus Tip:

Personalized jewelry tells your story and might eventually attract niche buyers, particularly if it blends quality and symbolism (birthstones, initials, spiritual motifs).

🌟 How to Maximize Your Jewelry Investment

-

📜 Always buy certified (GIA, IGI, BIS, Pt950, etc.)

-

🏷️ Understand the buy-back policy from the seller

-

💼 Choose timeless, minimalist styles for easier resale

-

🛡️ Store with proper care—scratches and damage lower value

-

📸 Keep photos, receipts, and appraisal documents

💬 Final Thought: Beauty That Pays

Jewelry can provide both financial gain and emotional fulfillment when it is chosen carefully. A combination of your resale strategy, budget, and style is frequently the best investment. It's safe to invest in gold, solitaire diamonds, and certified custom pieces, but keep in mind that the most valuable jewelry is one that has personal and market value.